Whether you’re an emerging-growth startup tracking toward your Series A, a large global brand preparing to go public or anything in between, navigating to your next stage of growth requires a unique marketing and PR plan.

For example, earlier-stage brands are likely focusing on evaluating their overall messaging and value proposition. Key considerations include whether they have the right marketing skills to create sustained awareness, how their thought leadership voices align with areas of expertise, etc. At the other end of the spectrum, later-stage brands are more likely assessing how to find the right advocates to support their path to M&A/IPO. They are also asking questions such as what foundation exists for going global or do they have the right global communications team in place to show a unified brand presence.

“At PAN, helping companies navigate growth is core to our agency’s DNA. Over the past year alone, we’ve put our NXT Stage approach into action for several B2B technology and healthcare IT/digital health clients at all stages of growth.”

At PAN, helping companies navigate growth is core to our agency’s DNA. Over the past year alone, we’ve put our NXT Stage approach into action for several B2B technology and healthcare IT/digital health clients at all stages of growth – e.g., GYANT ($13.6M Series A), Jobber ($60M equity round), OneStream ($200M Series B), Privitar ($80M Series C), LeanTaaS ($130M Series D), Cedar ($200M Series D), 908 Devices ($130M IPO), Absolute Software ($60M US IPO/dual listing), Payoneer ($3.3B SPAC), among several others.

U.S. Venture Funding: Where’s the Growth?

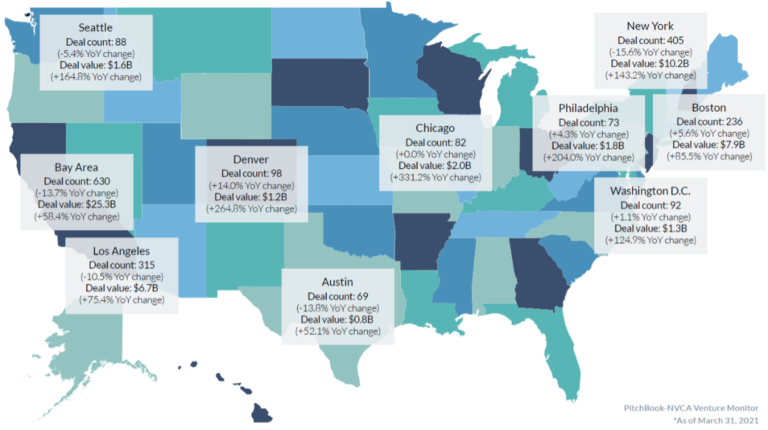

You’ve likely read about – or experienced first-hand – the growth in venture investment and exits in 2020. Not just within North America, but globally as well. Within the U.S. specifically, where exactly is this growth taking place? Let’s start by diving into the Venture Monitor report recently published by PitchBook and the National Venture Capital Association (NVCA), in partnership with Silicon Valley Bank and Secfi.

The regional spotlight below illustrates deal counts and deal values for Q1 2021 vs. Q1 2020 in major markets across the country. Interestingly, there were not any significant changes in the year-over-year (YoY) deal counts nationwide. The largest percentage changes were in Denver (14% growth) and New York (15.6% decline). The deal values, however, tell a much different story. As you can see, there was massive growth across the board – the largest of which was Chicago’s 331.2% YoY increase at a total $2B deal value. That said, to put Chicago’s $2B deal value into perspective, the Bay Area’s total deal value was $25.3B – a 58.4% YoY increase – indicating the Bay Area still holds the keys to VC, per PitchBook.

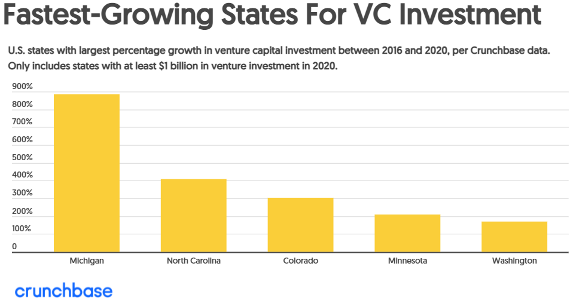

In addition, Crunchbase data tells a similar story, noting that California, Massachusetts and New York accounted for 73.1% of the approximately $161.5B of total venture capital in the U.S. in 2020. Over the past five years, however, the states which have experienced the fastest growth for venture capital investment include Michigan, North Carolina, Colorado, Minnesota and Washington, according to the Crunchbase data below.

NXT Stage in Action

Early Stage: GYANT

In a recent guest blog post for PAN, Michael Greeley, General Partner at Flare Capital Partners, explored the significant growth of VC investment within the healthcare industry. One example of a company navigating rapid growth in this sector is PAN client, San Francisco-based GYANT, an AI-driven virtual assistant for healthcare.

When the startup began working with PAN, our program focused on messaging/positioning, product collateral and website copy. As GYANT started to gain traction, our strategy shifted to an aggressive earned media and CEO thought leadership program to generate visibility while touting the company’s growth – with the goal of securing Series A funding, which the company closed in July 2020.

Leading up to the funding news, PAN worked with GYANT to craft the press release, an FAQ, updated messaging and a media outreach plan to target healthcare trade press and national business press. PAN’s efforts around the funding news garnered 41 media hits with 22.7B UVM. This feedback from Chris Farrell, GYANT’s SVP of Marketing, says it all: “PAN has been a wonderful strategic partner throughout GYANT’s evolution.”

Click through the slides below to learn more about how we supported GYANT.

Late Stage: Citrix

Another example of NXT Stage in action involves Fort Lauderdale-based Citrix, a digital workspace technology leader and global public company with which PAN recently celebrated its two-year partnership. During a 12-month span, PAN secured 12 broadcast segments and reached 18.8M people via Forbes, Business Insider, CNBC, etc., contributing to a 102% increase in “Future of Work” mentions from the first to second half of 2020.

Moving forward, PAN’s NXT Stage approach will continue to scale alongside Citrix through new creative campaigns, media relations and influencer engagement. While Citrix’s program evolves with its recent acquisition of San-Jose-based Wrike, a leader in SaaS collaborative work management solutions and recent addition to PAN’s client portfolio, PAN will assist in scaling and adapting PR and communications efforts.

How Can PAN Support Your Next Milestone?

PAN has 26 years of experience helping brands – nationwide and globally – scale and succeed. We know how to take companies through all phases, achieving their business and marketing objectives and successfully getting to their next stage. Take our assessment to see which growth stage your company is at and learn how PAN can help.