Michael Greeley, General Partner at Flare Capital Partners, offers his take on the healthcare industry’s growth and what it means from a venture capital perspective.

Healthcare technology investors are in a quandary. Business was really good last year, yet the world all around continues to suffer in so many profound ways.

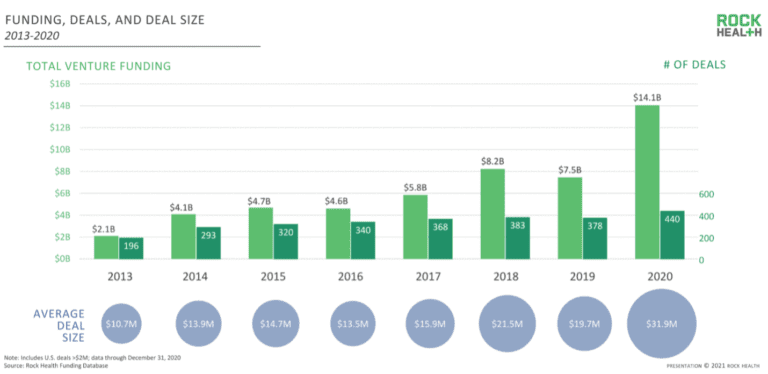

2020 investment data demonstrates that it was a very strong year for both new commitments and liquidity. According to Rock Health, a record $14.1 billion was invested in 440 companies; not quite doubling the $7.5 billion invested in 2019. Other sources tabulated somewhat different results, but the trend was the same (Mercom – $14.8 billion across 372 companies: MobiHealthNews – $13.8 billion across 637 companies). Notably, healthcare technology investment was just over 9.0% of all venture capital activity in 2020 ($156.2 billion – an all-time record high).

Rock Health identified four significant categories of activity:

- $2.7 billion invested in “on demand” healthcare

- $2.0 billion for drug discovery/development

- $1.8 billion invested in behavioral health companies

- $1.7 billion directed toward fitness/wellness opportunities

Interestingly, there were 40 financings that were greater than $100 million in size, accounting for 57% of the total activity – undoubtedly explaining why the average deal size spiked to be nearly $32 million, more than 50% larger than 2019’s figures. This is a clear indicator of maturity in the sector and that there are now a number of “emerging winners.” Liquidity in the healthcare technology sector was also quite robust with 145 M&A transactions, six IPOs and seven SPAC offerings.

The Role of COVID-19 in Shifting Healthcare Spend

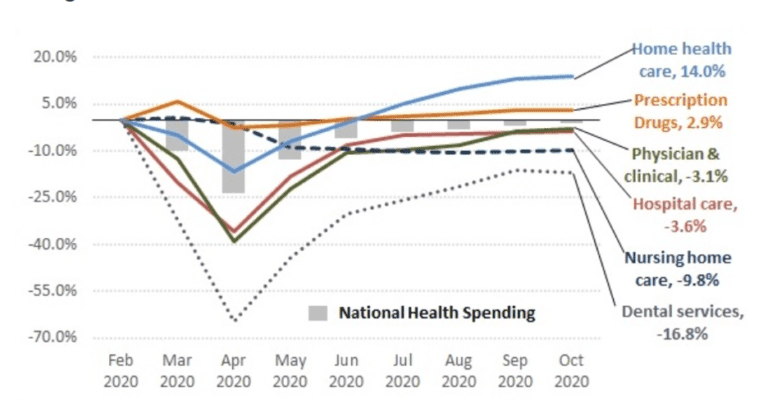

Undoubtedly, the pandemic played a significant role in all of this activity. According to an analysis by Health Affairs, in January 2020 (pre-pandemic) tele-visits were less than 1% of all doctor / patient interactions, but has grown to approximately 6% (and enjoying improved reimbursement rates). Further, whenever possible, home health replaced nursing home care. As the healthcare system rapidly moved to be more on-demand and virtual, providers scrambled to incorporate innovative solutions to ensure continuity of care.

“As the healthcare system rapidly moved to be more on-demand and virtual, providers scrambled to incorporate innovative solutions to ensure continuity of care.”

Through the ten months up to October 2020, healthcare spend was trending 2.3% below the similar 2019 period. Just over the course of the pandemic, there has been a dramatic rotation of healthcare spend to more “socially distanced” locations. Interestingly, prescription drug costs are running ahead by 2.9% since the onset of the pandemic.

Both the dramatic re-prioritization of budgets due to COVID-19 and the equally dramatic changing political environment point to continued sector strength.

It certainly appears that the Affordable Care Act will endure and will likely be strengthened to drive for lower premiums, better plan design, offering public options and perhaps even lowering the Medicare eligibility age to 60. Expansion of state Medicaid programs seems a near-certainty, as does regulatory initiatives to lower drug prices (such as allowing the government to negotiate prices). The long overdue scrutiny of racial disparities around access and quality of healthcare will push organizations to incorporate solutions to engage, activate and manage disadvantaged populations more effectively. The recently unveiled $1.9 trillion relief package provides additional tailwinds.

“The long overdue scrutiny of racial disparities around access and quality of healthcare will push organizations to incorporate solutions to engage, activate and manage disadvantaged populations more effectively.”

One particularly exciting development in 2021 will be the introduction of Direct Contracting, which is a Centers for Medicare and Medicaid Services (CMS) initiative to move a significant portion of the $450 billion of Medicare medical costs away from fee-for-service beneficiaries into value-based care models. Nearly 15% of Americans are on Medicare (~60 million people) and account for $325 billion of healthcare spend; Medicare Advantage is approximately 40% of that amount. The Congressional Budget Office forecasts that nearly 50% of the Medicare $450 billion may move into such arrangements by 2030.

Many healthcare technology entrepreneurs are eagerly awaiting the April 2021 roll-out of this program which promises to shift significant spend into novel arrangements that will require enhanced solutions to manage. While Direct Contracting patients may be slightly less profitable, given reimbursement benchmark discounts, there will be meaningfully lower member acquisition and claims processing costs. Economic value will be created by meaningfully outperforming the CMS benchmarks which will demand innovative approaches. One note of caution with the uncertain economics is the limited success of the CMS experiment with Accountable Care Organizations, which ultimately realized quite modest premium savings.

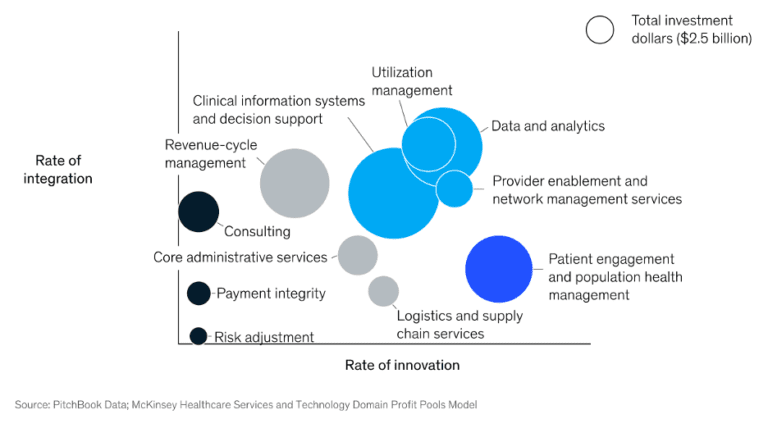

Given many of these forces, McKinsey & Co. has identified a number of healthcare technology sub-sectors that will show both high rates of client integration and innovation as the healthcare system is re-architected. These include data and analytic solutions, as well as utilization management, clinical decision support, and network management platforms.

The Impact of Healthcare Trends on the VC Landscape

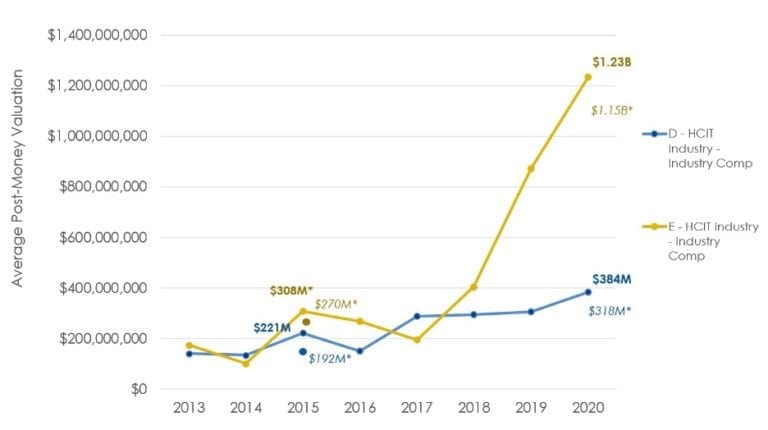

All of these forces and the dramatic venture capital inflows in 2020 have pushed valuation levels to historic highs for later stage rounds of financing.

Per Pitchbook, the average post-money valuations for Seed and Series A rounds in 2020 were $12.2 million and $40.5 million, respectively, which have remained relatively consistent over the last eight years. Starting in 2018, the post-money valuations of the Series B and C rounds increased significantly, reaching $146.9 million and $313.1 million in 2020, respectively. The average pre-money valuations for those rounds were $112.4 million and $258.0 million, suggesting that the average round sizes for Series B and C were approximately $35 million and $55 million, respectively.

Interestingly, the median post-money valuations over those series of rounds were $10 million (Seed), $30 million (Series A), $95 million (Series B), and $214 million (Series C), highlighting how the “mega rounds” have skewed the average to be nearly 50% greater than median across each stage of financing. Investors track closely the step-up in valuations over successive rounds, which while unrealized, indicates significant value-creation for early stage investors. Notably, the level of dilution incurred in later rounds tended to be between 20% – 25%.

The narrative is even more dramatic for the Series D and E rounds, which have average post-money valuations in 2020 of $384.0 million and $1.23 billion, respectively. The average pre-money valuations were $318 million and $1.15 billion, respectively, while the median post-money valuations were $295 million and $453 million, once again underscoring the dramatic impact of the “mega rounds.” The difference between average and median post-money valuations for the Series E rounds ($1.23 billion vs $453 million) is notable, and likely reflects the minting of a number of new unicorns.

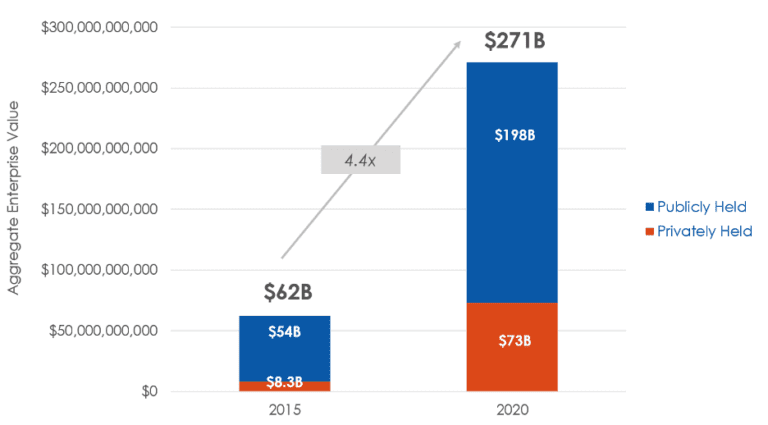

It is estimated that there are now 55 public and private healthcare technology unicorns (according to Flare Capital analysis) which compares to only 12 in 2015; those unicorns are collectively valued at $271 billion. Of the 55 companies, 21 are publicly traded, once venture-backed healthcare technology companies with an aggregate market valuation of nearly $200 billion. And they have traded very well in the public markets. The SVB Leerink Healthcare Technology and Services Index increased on average nearly 39% in 2020 (versus 18.4% for the S&P 500 index).

Just recently, this sector witnessed a handful of multi-billion dollar M&A transactions with UnitedHealth’s $7.8 billion acquisition of Change Healthcare, Amerisource Bergen’s $6.5 billion purchase of the Alliance pharmacy business of Walgreens Boots Alliance, and the $2.2 billion purchase of Magellan by Centene. The large incumbents will continue to be quite acquisitive to address gaps in their product portfolios and to drive top-line growth.

The Implications: Is This the Golden Age of Healthcare Technology?

As investors now navigate the challenges of 2021, the enduring question as to where we are in the cycle is resurrected. Are valuations too high? Is too much capital coming into the sector, too quickly? It certainly appears that 2015 vintage venture funds will be high performing funds given the number of large and important companies that are now operating. In 4Q20 there was $4.0 billion invested (equivalent to all of 2014), suggesting we are now on pace for $16.0 billion to be invested in 2021.

Place your bets – given the enormity of the healthcare industry, and now the profound urgency to improve how it functions, arguably we are on the threshold of a golden age for healthcare technology, so I will stand by that prediction.

We’re here to support your growing healthcare brand as the industry transforms. Learn how by reading about our NXT Stage Approach.