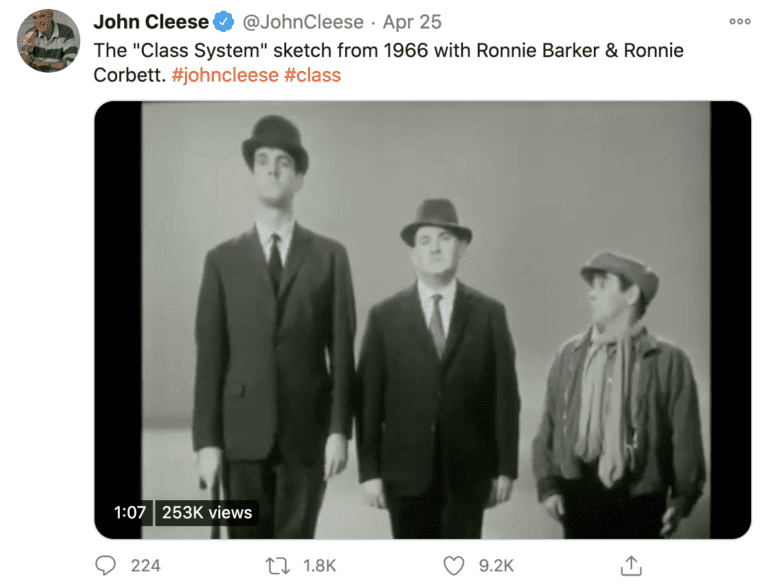

The image of a man in a pinstripe suit, sporting a bowler hat and carrying a brolley has been synonymous with banking in Britain for decades. It was even featured in one of the nation’s most famous comedy sketches about the British class system in 1966.

So when, five years ago, a new breed of banking entrepreneurs showed up wearing t-shirts and trainers, and promising to shake up financial services, the contrast proved irresistible to the media.

So when, five years ago, a new breed of banking entrepreneurs showed up wearing t-shirts and trainers, and promising to shake up financial services, the contrast proved irresistible to the media.

Those young founders of the likes of Monzo, Revolut and Transferwise have gone on to dominate the headlines when it comes to fintech. They launched their services with glossy photo shoots and shiny coloured bank cards and flooded advertising spots with ads carrying a distinctly human, and often cheeky tone of voice.

The early fintechs were quickly joined by hundreds of alternative personal finance services, tackling everything from credit scores to mortgages and savings. We’ve been lucky enough to work with the smart, ambitious founders of many of them, including Chip, Neos, Munnypot, Multiply and ClearScore.

B2B Fintech Market Is on the Rise

While consumer-driven brands were the initial focus in the fintech space, the companies now really catching the attention of influential journalists and analysts are the B2B players.

“While consumer-driven brands were the initial focus in the fintech space, the companies now really catching the attention of influential journalists and analysts are the B2B players.”

Investors are backing the B2B fintechs too. As Sifted reported in October, Dealroom data shows that so far in 2020, European fintechs raised €6.3bn; €5bn of which has gone to B2B fintechs and €3.1bn to their B2C peers.

On the face of it, these B2B companies may not be quite as sexy as their direct-to-consumer peers, but their importance is increasing.

Big Tech On a Collision Course with Banks

The march of the consumer fintech companies, combined with the threat of the Big Tech players (Amazon, Google, Apple and Facebook), has finally shaken the banks from their slumber. They’ve woken up to the need to transform their offerings and provide customers with better services and experiences that match the way we live our lives today.

They know they need to innovate more quickly and deliver services that hit the spot. To do this, they are increasingly turning to B2B fintechs that can support, develop and augment their digital offerings, but – crucially – don’t want to directly compete with them.

The B2B fintech players range from the leading “Banking as a Service” players, such as Thought Machine, TrueLayer and Railsbank, to more specialist service fintechs like Symmetrical (bank salary before pay day), Banked (direct bank-to-bank payments at checkout), and Cybertonica (AI and machine learning-powered cyber security for online banking).

A particularly hot area is in fast emerging sector known as “embedded finance.” Innovation here seeks to place traditional banking services into the flow of our everyday lives.

An example is banks adopting branded smartphone keyboards, built by B2B fintech PayKey, that their customers can then use to carry out transactions within popular messaging apps and other online services.

The Communications Challenge Facing B2B

Of course, a key challenge for the new breed of B2B fintechs is to establish trust and get noticed by the financial institutions they want to partner with. This can be a little less straightforward than for the B2C space.

“Of course, a key challenge for the new breed of B2B fintechs is to establish trust and get noticed by the financial institutions they want to partner with. This can be a little less straightforward than for the B2C space.”

The B2B fintech offerings often appear more technically complex, and it’s less easy to see the immediate benefit to consumers – something mainstream media often want.

And, while the early fintechs often used a clear “pick a fight” communications strategy – attacking the lumbering inertia of incumbent banks (another bank funeral stunt anyone?) – the B2B companies often want to befriend, not embarrass, the banks.

So how might they do this?

Bring the Benefits to Life

First, they need to find imaginative ways to bring to life just how smart their tech really is, while not detracting or stealing the limelight from their customers – the banks themselves.

Chip manufacturers, who have to play a similar role as “ingredient” brands might offer some pointers. Recently, when chip manufacturer ASML wanted to explain the critical role its tiny chips played in the creation of the new iPhone 12, it focused on the exceptionally precise engineering involved in making nano chips. “What they’re doing,” the BBC reported, “is akin to hitting a postage stamp on the surface of Mars with a paper aeroplane.”

Back Your Story Up with Data and People

Second, using data to make the case for why change is needed is a must – for example, insight around the kinds of consumer behavioural change that is driving the need for innovation. Ideally, this should be supported with human interest stories – case studies of how people are affected.

Lean into Mistrust of Big Tech

Third, it is possible to lean into the mistrust that is growing around the Big Tech companies.

PayKey’s visionary CEO Shelia Kagan has written eloquently about how B2B fintechs might be the saviour of banks in the face of the Big Tech assault.

One of her central points is that, while people may not like the traditional banks, they do trust them with their money. They’ve done so for hundreds of years. This is a hugely important factor at a time when privacy concerns around the Big Tech companies are heightened, and their motives are receiving a healthy dose of skepticism.

Similarly, highlighting the shortcomings of some B2C fintechs, and how banks, with the help of B2B fintechs, are well placed to solve these issues, is likely to be of interest to media. After all, the challenger banks have delivered some fabulous services, but the need to turn customer growth into revenue growth has meant that recently some have begun to resemble the very banks they set out to disrupt. Could it be that some turn out to be wolves in sheep’s clothing?

For more tips on how your brand can cut through the noise, read our blog “How to Help Your Fintech Brand Stand Out in a Crowded Market“

Enlisting an Agency to Help Tell Your Story

At PAN we are passionate about fintech – both B2C and B2B. We’re helping many innovators in this space get their message across and helping build a more vibrant and effective financial services sector in the process. Are you ready to join us?

For additional guidance around how to develop the right integrated marketing and PR strategy for your growing technology brand, download this resource “How to Use Creativity to Find Opportunity During a Downturn.”